paul tudor jones 200 ma | paul tudor jones paul tudor jones 200 ma PFJ: My metric for everything I look at is the 200-day moving average of closing prices. I’ve seen too many things go to zero, stocks and commodities. The whole trick in . AAPL stock has split a total of 5 times since 6/16/1987. How many shares would one share of Apple Inc (AAPL) from 6/16/1987 be worth today? After splits, one share of AAPL stock from 6/16/1987 would be worth 224 shares today.

0 · paul tudor jones trend

1 · paul tudor jones reviews

2 · paul tudor jones books

3 · paul tudor jones 200 days

4 · paul tudor jones 200 day rule

5 · paul tudor jones

Passed by Congress on January 31, 1865, and ratified on December 6, 1865, the .

Paul Tudor Jones is a legendary trader, and self-made Billionaire. His laser like focus on risk-management, like most successful traders, is evident here in this discussion of . We present a 200-day moving average strategy and the simple 200-day moving average rule. Also a couple of quotes by Paul Tudor Jones about the 200 day MA. The main . PAUL TUDOR JONES - Is a billion dollar stock trader and was ranked as the 108th richest man in the world on the Forbes 400 rank.Jones is the founder of Tudor.

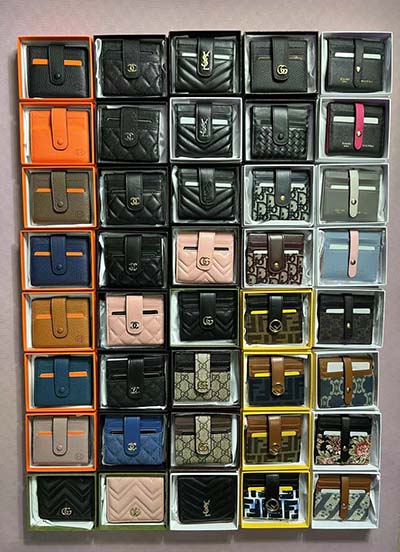

cinture gucci finte che costano poco

PFJ: My metric for everything I look at is the 200-day moving average of closing prices. I’ve seen too many things go to zero, stocks and commodities. The whole trick in . "As the legendary hedge fund manager Paul Tudor Jones said: 'The whole trick to investing is: 'How do I keep from losing everything?' If you use the 200-day moving average rule, then you.

Freebies mentioned in the videos:⮕ 🚀 New to Axie Infinity? Use my Lunacian code: 9EAUEKLT⮕💰 FREE 10 € on Reinvest24: reinvest24.com/en/r/t1fpcccs⮕💰 . Among many things, Paul Tudor Jones is famous for his comments on the benefits of the trading indicator 200-day moving average. Paul Tudor Jones trading rules were being long when the price is above and short out . The 200 day moving average was popularized by Paul Tudor Jones who used it to successfully avoid the stock market crash of 1987. It’s said that Jones exited most of his long .

Paul Tudor Jones, who was one of the lucky guys to make a fortune in 1987 says that he used the 200-day MA as a sign get out and get short. He made 127% net of fees that . Discover Paul Tudor Jones' macro trading approach. Learn how he analyzes global trends and manages large trades with insights into his successful strategies.

Tại sao Paul Tudor Jones sử dụng đường MA200 ngày để lọc xu hướng? Posted on 3 Tháng Tám, 2018 3 Tháng Tám, 2018 by Huy truong minh. . Nói tóm lại, đừng sử dụng đường MA 200 ngày thành một công cụ giao dịch máy móc: “Giá trên MA 200 ngày thì mua và dưới MA 200 ngày thì bán” như . Paul Tudor Jones là một trader huyền thoại và là một tỷ phú tự thân. Giống như hầu hết các trader thành công, ông cũng thể hiện rõ sự chú trọng vào khâu quản lý rủi ro, cụ thể là qua cách ông sử dụng dụng đường .Ok I spent a sec to see why my chart looked different, I was using tos sma period set to 200 it auto set the interval from the chart, my bad. Still in early and mid June spy dips below the 200 day ma then just turns around. But yeah I messed up my chart zooming in/not paying attention That same month, the Tudor Futures Fund, managed by Paul Tudor Jones, registered an incredible 62 percent return. Jones has always been a maverick trader. His trading style is unique and his performance is uncorrelated with other money managers. Perhaps most important, he has done what many thought impossible: combine five consecutive, triple .

Paul Tudor Jones 1 ใน Market Wizard ผจก. Hedge Fund เคยกล่าวไว้ว่าจงร่วมเป็นส่วนหนึ่งไปกับแนวโน้มใหญ่เสมอและตัวชี้วัดในทุกสิ่งของผมคือเส้นค่าเฉลี่ย 200 วัน In 1985, Tudor’s first full year of trading, Jones returned 136%, and 99% in 1986. In 1987 Tudor Investment Corp returned almost 200% and a net total of 125.9% after fees as Paul Tudor Jones betted on a big downturn in the US Stock Market, known as the Black Monday. In 1990 Tudor Jones' return achieved 87.4% when the market in Japan dropped.

Paul Tudor Jones, el arte del trading agresivo. Octubre de 1987 fue un mes devastador para mucho inversores, en la medida en que los mercados bursátiles mundiales fueron testigos de un crash que rivalizó en virulencia con el de 1929. Ese mismo mes, el Tudor Jones Fund, gestionado por Paul Tudor Jones, registró un increible retorno del 62%.

The 200 day moving average was popularized by Paul Tudor Jones who used it to successfully avoid the stock market crash of 1987. It’s said that Jones exited most of his long trades in the run up to the crash as they dipped below the 200 day MA. This saved Jones from huge losses in one of the biggest stock market crashes in history. Paul Tudor Jones là huyền thoại trong giới tài chính. Ông kiếm đậm trong nhiều sự kiện đen tối của thị trường chứng khoán, bao gồm cú đổ vỡ của bong bóng cổ phiếu Nhật Bản năm 1990 và bong bóng công nghệ Mỹ đầu thế kỷ 21. . What is the 200-day moving average and how is it used in trend-following strategies? The 200-day moving average is a simple technical indicator that calculates the average closing price of an asset over the past 200 days. In trend-following strategies, particularly as discussed by Meb Faber and Paul Tudor Jones, it is used as a trend filter.

"The Wisdom of Paul Tudor Jones" by Jeff Pierce, www.businessinsider.com. December 22, 2010. 18 Copy quote. The concept of paying one-hundred-and-something times earnings for any company for me is just anathema. Having said that, at the end of the day, your job is to buy what goes up and to sell what goes down so really who gives a damn about PE's?If you use the 200-day moving average rule, then you get out. You play defense, and you get out. Tony Robbins: That is considered one of the top three trades of all time, in all history (1987 Crash)! Did your theory about the 200-day moving average alert you to that one? Paul Tudor Jones: You got it. It had done under the 200-day moving target. Paul Tudor Jones’ Tudor Investment Corporation trading strategy. Among many things, Paul Tudor Jones is famous for his comments on the benefits of the trading indicator 200-day moving average. Paul Tudor Jones trading rules were being long when the price is above and short out when it’s below is just like playing defense, he argues.

Paul Tudor Jones determines the market trend by looking at the 200-day moving average of closing prices. According to Paul when you use the 200-day moving average as an indicator for when to really get out of your position you’ll never be going against the main long term trend. Paul Tudor Jones is a legendary trader, and self-made Billionaire. His laser like focus on risk-management, like most successful traders, is evident here in this discussion of how he uses the 200-day moving average, my core trend following signal as well, to manage risk. We present a 200-day moving average strategy and the simple 200-day moving average rule. Also a couple of quotes by Paul Tudor Jones about the 200 day MA. The main advantages of the 200-day moving average are simplicity, riding the trend, and playing defense.

PAUL TUDOR JONES - Is a billion dollar stock trader and was ranked as the 108th richest man in the world on the Forbes 400 rank.Jones is the founder of Tudor.

PFJ: My metric for everything I look at is the 200-day moving average of closing prices. I’ve seen too many things go to zero, stocks and commodities. The whole trick in investing is: “How do I keep from losing everything?” "As the legendary hedge fund manager Paul Tudor Jones said: 'The whole trick to investing is: 'How do I keep from losing everything?' If you use the 200-day moving average rule, then you.

Freebies mentioned in the videos:⮕ 🚀 New to Axie Infinity? Use my Lunacian code: 9EAUEKLT⮕💰 FREE 10 € on Reinvest24: reinvest24.com/en/r/t1fpcccs⮕💰 . Among many things, Paul Tudor Jones is famous for his comments on the benefits of the trading indicator 200-day moving average. Paul Tudor Jones trading rules were being long when the price is above and short out when it’s below is just like playing defense, he argues. The 200 day moving average was popularized by Paul Tudor Jones who used it to successfully avoid the stock market crash of 1987. It’s said that Jones exited most of his long trades in the run up to the crash as they dipped below the 200 day MA. Paul Tudor Jones, who was one of the lucky guys to make a fortune in 1987 says that he used the 200-day MA as a sign get out and get short. He made 127% net of fees that year. Not everyone was as fortunate as PTJ in 1987.

paul tudor jones trend

Single Malt Scotch Whisky. Highland. Aberfeldy. Aberfeldy 12 Year Old. A fruity, clean and polished malt with a touch of honey and spice, Aberfeldy 12 Year Old is an excellent introduction to this Highland distillery.

paul tudor jones 200 ma|paul tudor jones